Child Care and Camp Payment Receipts

Your child care and camp payment receipt for 2025 is now ready for you to download. This receipt includes all programs on your account that are eligible to be claimed in your 2025 tax return.

Receipts Available Online

Payment receipts for tax purposes have been conveniently saved in your My Y account. This enhancement aims to provide easy access to financial documents all year, ensuring a seamless experience during tax season.

Signing into My Y

My Y is your account management system. It is your one-stop for buying a gym membership, signing your children up for camp, registering for lessons, and accessing your payment receipts.

If this is your first time accessing your My Y account:

- Go to ygta.ca/MyY.

- Select “Sign In/Up.” Do not select “Create a My Y Account.”

- Enter the email address you used to register for YMCA services. If you do not remember the email address you used, please contact Customer Service for assistance.

- Select “Forgot your password?”

- Create a password to access your account.

Downloading Your Receipt

Receipts are self-serve. No need to check your mailbox or inbox before filing your 2025 taxes; just log in and download at your convenience.

- Sign into your My Y account.

- Select “My Payments and Registrations.”

- Select “My Tax Receipt.”

- Select the tax year and payer.

- Select "Generate Tax Receipt."

This process may take a few minutes. Please do not refresh your browser or exit the screen while your receipt is being generated. - If your browser prevents the report from opening, select “OK” to allow it.

- Download and print your receipt.

Please note: If your receipt does not appear when you follow the steps above, you may need to allow pop-ups in your browser.

Allowing Pop-Ups in Chrome

After you've turned off the pop-up blocker, you should be able to see your payment receipt. Remember to be cautious and only allow pop-ups on trusted websites to avoid potential security risks.

On Desktop

On Desktop

- Open Google Chrome on your computer.

- In the top right corner, click on the three vertical dots to open the Chrome menu.

- Select "Settings" from the dropdown menu.

- Scroll down and click on "Privacy and security" in the left sidebar.

- Under the "Privacy and security" section, find and click on "Site settings."

- Look for the "Pop-ups and redirects" option.

- Toggle the switch to turn off the pop-up blocker. The switch should be greyed out when turned off.

On Mobile

On Mobile

- Open the Chrome app on your mobile device.

- Tap on the three vertical dots in the top right corner to open the menu.

- Select "Settings" from the menu.

- Scroll down and tap "Site settings" under the "Advanced" section.

- Find and tap on "Pop-ups and redirects."

- Toggle the switch to turn off the pop-up blocker. The switch should be greyed out when turned off.

Frequently Asked Questions

No. Receipts for all children on your account are included in one document. It will show the total for each child and all registrants combined.

If you paid fees in 2024 for a program delivered in 2025, it will show on your 2025 receipt.

Yes. Starting this year, payment receipts for tax purposes will be conveniently saved in user accounts. To access receipts for years before 2023, please contact Customer Service for assistance.

No. Donation receipts will not be available through My Y. Tax receipts for one-time gifts to the YMCA of Greater Toronto made online are emailed shortly after the donation is made. Annual consolidated tax receipts for recurring donations made throughout 2025 will be issued by February 27, 2026. If you are having trouble locating your receipt for a 2025 donation, email giving@ymcagta.org.

Please contact YMCA Member Services for assistance. Call 416-928-9622 or 1-800-223-8024, or email receipts@ymcagta.org.

Your payment receipts for tax purposes are conveniently save in your My Y account. An active registration is not required to access it.

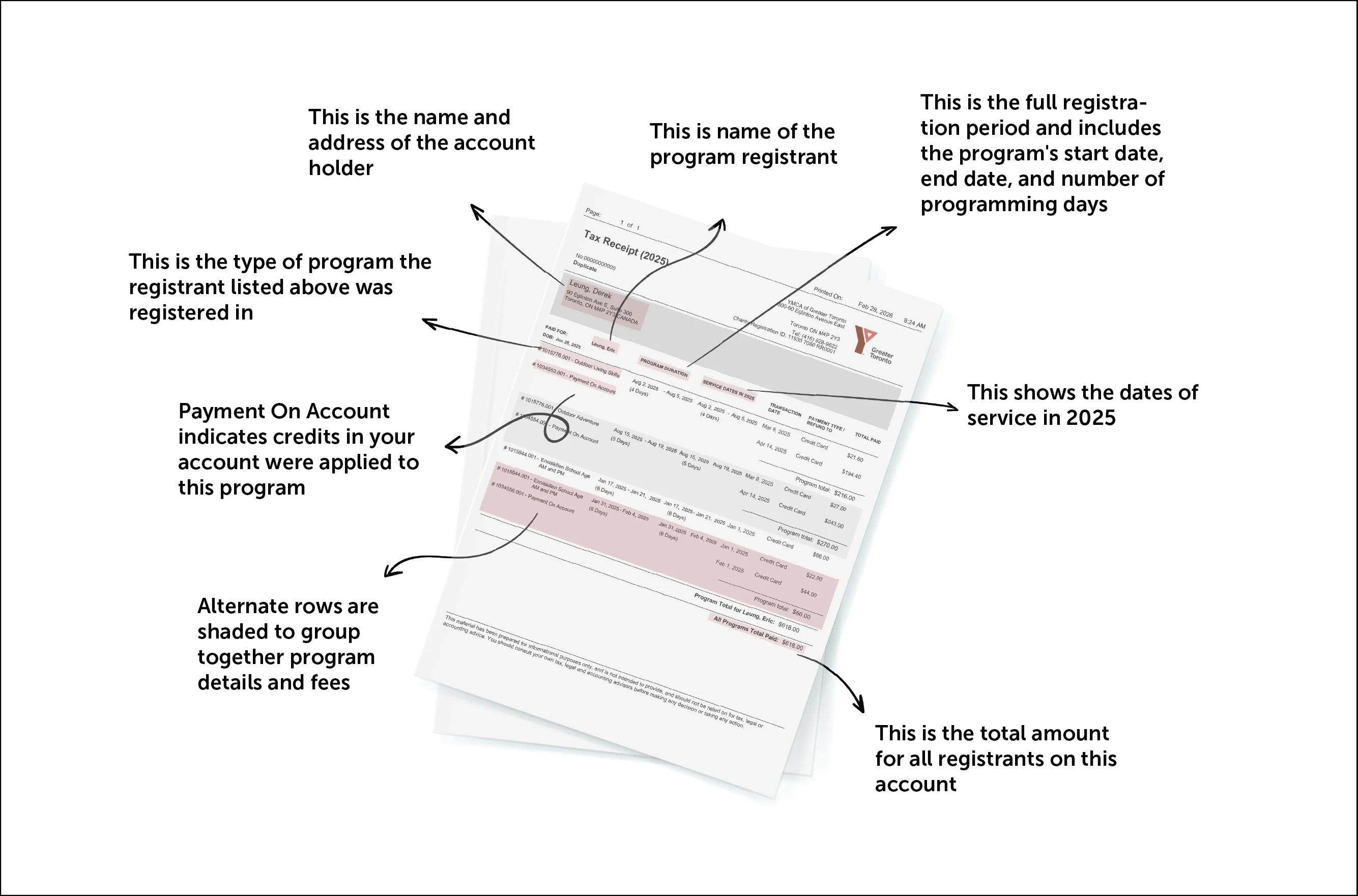

Reading Your Receipt